City Budget Review Schedule

March 14: Public hearing; consideration of real estate tax rate to be advertised

March 28: Public hearing; work session

April 4: Work session

April 11: Introduction of tax rates for commercial and industrial property, and wastewater;

April 25: Real-estate tax-rate public hearing; work session

May 3: Special public hearing (on a Wednesday) and budget adoption.

Meetings and work sessions are held in the City Hall Annex, 10455 Armstrong St., and are televised on Cityscreen-12; schedule is subject to change.

The budget is a detailed description of how City taxpayer money is spent. It explains the city’s goals, proposed programs and activities for the coming fiscal year. It also includes year one of the five-year Capital Improvement Program. Copies of the proposed budget are available in print and via www.fairfaxva.gov/. For more information, call 703-385-7870.

There’s good news for homeowners in the City of Fairfax: City Manager Bob Sisson’s proposed budget for Fiscal Year 2018 is calling for no increase in the real-estate tax rate. That means it most likely will remain at its current level of $1.0645 per $100 assessed valuation.

The budget is slated for adoption on May 3. But before then, Mayor David Meyer and the City Council members will scrutinize the document thoroughly and make their own changes and recommendations before giving it their seal of approval and officially setting the real-estate tax rate.

The public, too, will be able to weigh in during public hearings set for March 14 and 28, April 25 and May 3. Meanwhile, last Tuesday, Feb. 28, Sisson gave a budget presentation to the Council.

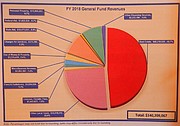

“We have a balanced budget,” he said. “We’re proposing $173,149,697 in total spending — a 4-percent increase over the current year. The proposed General Fund expenditure is $140,209,067 or a 3.5-percent increase over FY17.”

Noting some things he and his staff took into consideration as they prepared the budget, Sisson said funding the City’s CIP (Capital Improvement Program) is “always a challenge.” And he said the City’s school-tuition contract with Fairfax County Public Schools is $48.6 million, a nearly 3-percent increase or $1.4 million.

TOTAL SPENDING on education is expected to be $55.6 million.

Sisson said there are some requests for additional City personnel and the debt service on past expenditures is “significant.” However, he added, “Most of it was the result of bond referendums passed and relating to the schools.”

He stressed, as well, that 60 percent of the City’s General Fund expenditures — some $83 million — is for nondiscretionary expenses. These are non-negotiable items for certain services and contracts, such as the school contract with FCPS, debt obligations, pension benefits, and fixed costs including debt payments for the wastewater treatment plant.

On the positive side, even though real-estate tax revenue isn’t predicted to increase by much — just $1.9 million — Sisson said, “Any growth in our real-estate tax base is good. And we have a relatively low increase in our school contract. We’ll have a snow-removal savings this year because of the mild winter, and FEMA will reimburse a significant sum of money to the City for last year’s severe winter.”

He said Fairfax is also going through a school-debt refunding to reduce its debt, will have a savings in its recycling contract and will only have “minimal” increases in its health-care expenditure. “We’re seeing personal property tax revenue increases, and we’ve received several outside grants,” said Sisson. “So this has been an unusual year, and we’re not going to recommend a real-estate tax increase.”

He is, however, proposing a one-fourth of a penny increase in the stormwater tax. For the owner of a $500,000 house, it would mean roughly a $66 increase in the tax bill because of hikes in property assessments, as well. But the rise in the stormwater tax is anticipated to generate some $1.4 million to help the City fund several projects dealing with aging infrastructure, plus comply with state and federal regulations regarding stormwater management.

Returning to the General Fund, Sisson said education is “by far, our biggest expenditure,” receiving 40 percent of the total. Next come fire and rescue, police, public works and City government. Real-estate taxes comprise the largest portion of the General Fund revenues. But, said Sisson, “A sign of a healthy, diversified economy is that we’re below 50 percent reliance on the real-estate tax.”

He said the City has $4.6 million in additional expenditures projected for FY18. “We’re recommending merit raises of 2.5 percent, down from 3.5 percent in the current year, and a cost-of-living increase of 2 percent for all employees,” said Sisson. “And we’d like to add four, full-time equivalent positions to City staff.”

He also noted the increase in the school-tuition contract. And he said Fairfax is paying about $1.2 million annually in debt repayment for the undergrounding of utilities, plus transportation improvements done several years ago.

For FY18, he recommended $100,000 for the City’s Economic Development Opportunity Fund and $160,000 for other Economic Development Authority initiatives. “I’m pleased with the work of our new [Economic Development] Director [Chris Bruno] and the work he and the EDA are going to be doing,” said Sisson.

“We’re recommending a 6.5-percent transfer [$8.9 million] from the General Fund to the CIP,” said Sisson. The money will go toward a substantial number of needed improvements and equipment to benefit City infrastructure, programs and services.

AT THE START of the meeting, Kirk Holley, chairman of Fairfax’s Community Appearance Committee, addressed the Council. He’s part of an informal group trying to improve the appearance of the downtown area. “We believe it should be an attractive place where people want to come and stay a few hours,” he said. “We’ve made a lot of improvements, but we also need to improve the lighting, sidewalks, pedestrian access, greenery and maintenance.”

Holley said an overall plan is needed, plus a project sequence that makes sense. “We’ve given a list to staff, and they’ve put some money for it in the proposed FY18 budget, in the Old Town Service portion,” he said. “Please support this funding so we can invigorate the downtown.” Sisson heeded his request and is recommending $150,000 for it in the budget.

In addition, he said, the City pays $5.6 million per year to the county for upgrades to the Noman Cole Water Treatment Plant. It also costs $5.7 million per year for in-City work to maintain “our [wastewater] transmission and collection system, plus debt service,” said Sisson. “So we’re recommending a rate increase of 10 percent to continue to pay the bills. The average, household quarterly wastewater utility fund payment goes from $165 to $181.”

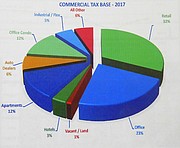

He’s also recommending a transportation tax fund rate increase from 9.5 cents to 10.5 cents for commercial and industrial properties. All residential properties are excluded from this tax. The money is used solely for transportation and transit purposes and enables the City to quality for matching funds for various transportation projects.

Somewhere down the road, said Sisson, Fairfax will have to consider major capital expenses such as an additional fire station, school life-cycle needs and a community center. But meanwhile, he said, “Hopefully, the redevelopment of mixed-use projects will bring new revenue, new people and new vigor to the community.”

“We have about $400 million of private and public construction either happening now or in the queue,” he continued. “And never in the City’s history has it been on this threshold where it’s so primed for economic growth.”

Sisson then thanked the department directors, plus Finance Director David Hodgkins, Budget Manager Kerry Kidd and City Clerk Melanie Crowder for their help in preparing the budget. “We’ll get into the details of this budget over the next two months,” said Mayor David Meyer. “And we welcome robust participation by all interested persons.”