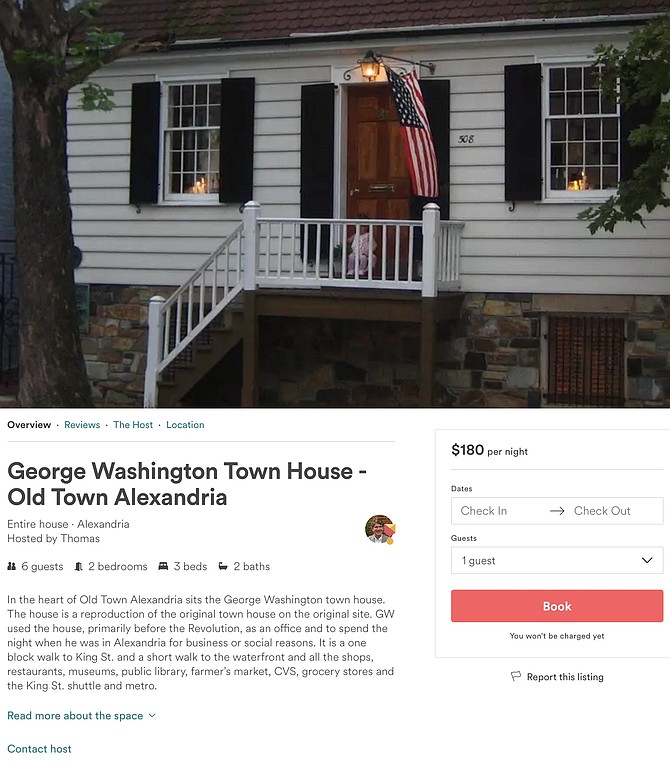

George Washington's Town House is one of the properties listed on Airbnb. The cost to rent it is $180 a night.

For the last few months, city officials have been working behind the scenes to create a registration system for people who rent out their homes through Airbnb. Now they’ve created the online database, and they’re about to launch a campaign to let all the home-sharing businesses know it’s time to register with the city and start paying taxes. The exact number of rental properties is unknown, although the estimate is somewhere between 250 and 500 properties. That's an estimated tax revenue of $100,000 to $200,000 a year.

"That’s their national business model, not to provide a list of who their hosts are,” said Kevin Greenlief, assistant director of finance and revenue. "We’re working with Airbnb and third party data analytic companies to help identify for us who’s actually in the city doing home sharing."

In the past few years, home sharing has become a hot new industry — a sort of startup rival for the traditional hotel industry. Airbnb has the lion’s share of the market, but it has competitors. They include Expedia, FlipKey, HomeAway, TripAdvisory and craigslist. The list of available homes in Alexandria includes George Washington’s Townhouse on Cameron Street, which can be rented for $180 a night. So far, Alexandria hotels haven’t seen much of a cut into their bottom line yet, although the industry is already adapting in anticipation of potential changes.

"The emergence of homestays will likely impact the share of overnight business occurring at hotels,” said Tom Kaiden, chief operating officer of Visit Alexandria, in an email response to questions. "The general trend is that our hotel supply is moving away from extended stay and budget and moving towards boutique and upper midscale.”

THE EMERGENCE of the home-sharing industry has seen a rising interest among neighborhood associations and city governments in Virginia. Homeowners have expressed concerns about strangers showing up and setting up camp unexpectedly. And local government leaders have expressed an interest in getting some of the money generated by the emerging industry, one that operates largely in the shadows. That led members of the General Assembly to pass a new law last year that allows local governments to create registration systems to force home-sharing businesses to share the wealth.

“Who’s getting money from the hotel industry can probably tell you who is doing the most on behalf of the hotel industry to make it more cumbersome for Airbnb to operate,” said Geoff Skelley at the University of Virginia Center for Politics. “For example, (Senate Majority Leader) Tommy Norment has gotten a lot of money from the hotel industry.”

Alexandria is one of the first local governments to create a registration system under the newly created authority, although leaders in neighboring Arlington took action before the bill was signed into law. Faced with a rapidly growing home sharing in Rosslyn and Crystal City, the Arlington County Board members created a permitting system in December 2016 for what they called “accessory short term homestay use” under its zoning ordinance.

“Our goal is to balance neighborhood interest and also making sure that people can use their homes and their properties in this way,” said Arlington County Board member Katie Crystal. “And then we had to amend our zoning ordinance amendments to participate and do short term sublets.”

ALEXANDRIA’S REGISTRY is technically online now, although city officials have not yet rolled out a public relations campaign letting home share businesses know it’s there. That's expected in the coming weeks. And fortunately for property owners who rent out their homes, they won’t have to deal with the headache of calculating the transient lodging tax of 8.5 percent plus $1 per room per night. All of that will be done by Airbnb for them.

"The law only pertains to the registry. It doesn't pertain to the collection of the tax," said Greenlief. "So we’re working with Airbnb to come up with a facilitated process where they actually help collect the tax and forward it to the city.”