A new database for tracking Alexandria’s Master Plan shows the city has generally made the most progress in infrastructure and community development and least in commercial development.

The Master Plan comprises plans guiding development in 18 neighborhood-level “small areas,” as well various citywide subjects, like transportation, housing, open space, etc. These date back as far as the 1990s, though the city has updated many of them.

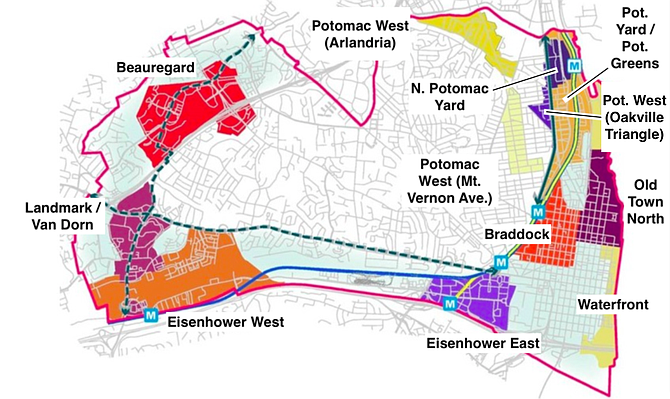

The FY 2018 Status of Implementation Report, issued this summer, shows the new tracking database’s results for selected small areas, or portions of small areas, in the so-called “growth crescent.” The growth crescent refers to “areas within the city well served by transit where most development is expected to occur,” according to the report.

For these areas, the report tracks progress to date in relation to five measures. “Community development” includes activities like “community outreach, economic development strategies, public art, historic preservation, and construction of public and institutional buildings,” according to the report.

“Progress against the goals and tasks developed with the community for these long-range plans tends not to be linear, but rather responds to market conditions and city initiatives and investment over time,” said Planning and Zoning’s Carrie Beach. “Where commercial and residential development are lower relative to expectations, the city has invested in implementation of community development or open space goals, such as purchasing and/or improving open space, conducting preliminary studies, and establishing implementation advisory groups.”

City Manager Mark Jinks says commercial development has been slow in part because the city’s limited office sites around Metro, as well as available capacity and competition from places like Crystal City, Rosslyn and Tysons Corner.

“The ramifications of a slow growing commercial tax base means there has been more pressure to increase the city’s real estate tax rate, as well as to reduce spending in many areas due to limited new resources,” he said. “It has also meant that to compete for tax base growth, the city had to start to provide limited financial incentives to retain or grow new economic activity, such as the National Science Foundation (NSF), which received a partial real estate tax exemption in order to move their headquarters and 2,200 NSF employees to the city.”

Stephanie Landrum, CEO of the Alexandria Economic Development Partnership (AEDP), said: “Securing new commercial development in our transit-oriented neighborhoods is a priority…to realize the vision in our small area plans for mixed-use, 24/7 communities and to balance revenue growth among residents and businesses. Over the last two years, we have seen commercial growth begin to take shape in both Potomac Yard and Carlyle/Eisenhower Avenue driven by full building pre-leases (National Science Foundation) and owner/occupier financing (National Industries for the Blind and the American Physical Therapy Association). Until we see office vacancy rates in all business districts throughout Alexandria, Arlington and D.C. drop, it will be difficult for developers to finance speculative office buildings.”

For the full report, visit www.alexandriava.gov/Planning.