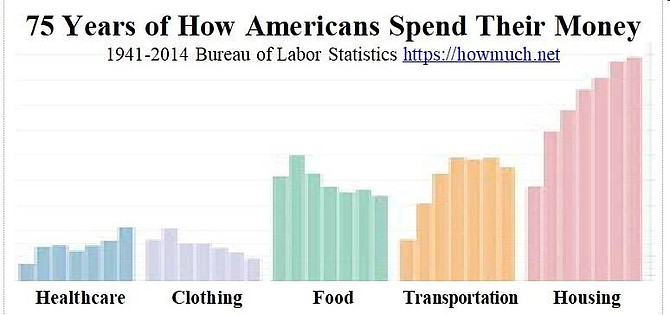

This historic chart confirms just how severe the burden of housing is on household budgets. It was always an essential, significant expense, but it now takes more than double the chunk out of our budgets that it once did.

The major cause is lack of housing supply driving costs up through the domino effect of competition from higher income buyers/renters inflating the price of all housing but especially the limited stock of affordable housing. Reversing the escalating domino effect on housing affordability is many-faceted. However, it’s important to be aware of public policies that can have the result of adding to housing costs. Two current issues center on the Federal Reserve’s effort to control inflation and on the push to cut Virginia state taxes rather than fund local schools.

Last summer, the price of gasoline was hovering around $5 a gallon pushed by world politics. That hit on household budgets faded as has the general impact of inflation which, as of June, has slowed to only 3% compared to its 1981 record-tying high of 9.1% a year ago.

All good, except for the fact that the Feds effort to control market basket inflation by raising interest rates has a long-term impact on housing affordability. Last year, you could get a long-term fixed rate mortgage at 5% – now you must cope with paying 7% over 30 years. Rents are equally impacted due to the business model of routinely re-financing commercial properties to cover the cost of running the property.

The second impact on the cost of housing is how the Virginia General Assembly will resolve cutting state taxes versus addressing under-funded schools. What does state school spending have to do with the cost of housing? The major item in local budgets is funding schools – the major source for local funding is the real estate tax. The major item in the state budget is funding schools – the major source for state funding is the individual income tax. This makes it a

given that a permanent cut in Virginia’s top income tax rate will translate directly into less state funding being available for local schools and the difference will directly impact the local real estate tax rate.

For those who think state school funding can take some paring back based on hearing an often-repeated political declaration that a given year’s state budget included the most ever for public schools, the facts tell otherwise. The fact is each year’s spending has to cover more students, as well as cover inflation. The fact is our state funding not having adequately covered these factors has resulted in Virginia spending less per student adjusted for inflation than we did in 2008, while other states are now spending more – on average 8% more.

Equally concerning is Virginia also has fallen behind its own adopted standards of education to support such basics as competitive salaries to attract and hold qualified teachers, smaller class sizes, and essential enhancements not just for students with learning difficulties but for mental health. On July 10, Virginia’s non-partisan Joint Legislation Audit and Review Commission released a two-year, detailed study confirming the state’s under-funding by as much as $3.5 billion a year. Not beginning to address this significant shortfall in the state budget and putting more pressure on real estate tax rates and on household housing budgets is not the answer.