As Fairfax County moves closer to FY25 budget public hearings April 16 through 18, individual districts are holding budget town halls to gather residents’ input. The year’s budget planning cycle began with County Executive Bryan Hill’s presentation of the “advertised budget” to the Board on Feb. 20.

Supervisor Rodney Lusk, Franconia District, held his town hall, virtually, on March 22, with assistance from Bryan Hill; Franconia District school board member, Marcia St. John-Cunning; and school board chief financial officer Lee Burton. Lusk invited residents to provide input and submit questions through email, call-in and Facebook.

Opening the session, Lusk noted, “One of the most important roles that I have in this job is to advocate on behalf of the Franconia District residents for budget priorities and improve their lives and grow our community as your county supervisor.” Lusk spoke of regional market forces which drive rising real estate tax assessments and personal property values. Real estate assessments have risen this year by 3.2 percent. Lusk said Fairfax County is “one of the most desirable locations to live in the country. As a result, housing prices are increasing as more and more people compete for fewer homes. … I remain committed to advocating for a reasonable adjustment to the real estate tax rate and personal property tax assessments.”

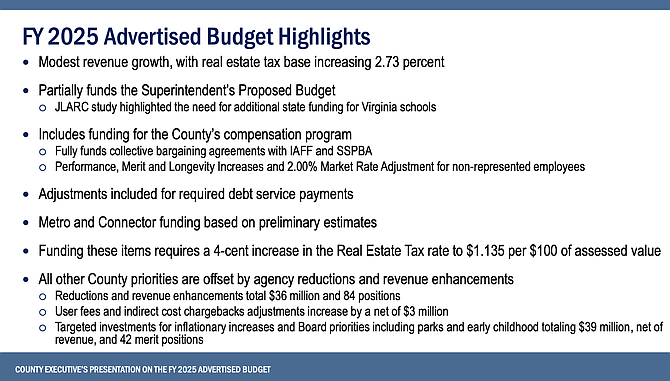

Lusk called this budget year “especially challenging,” citing a very competitive labor market for employees, with increased competition for police officers, firefighters, teachers, trash collectors, engineers, planners, transit workers, and others needed to maintain a high level of service. Meanwhile, the post-pandemic decrease in office values and rising vacancy rates negatively impacts county revenue. The county’s FY25 budgeted operating contribution of $203.7 million is a 21.3 percent increase over the $167.9 million subsidy over FY24. As a final factor, Lusk recognized “the approximately 51.4 percent of every dollar in the proposed budget goes to supporting our school system. The budget request from the school board this year includes a 10 percent increase over last year’s budget request, for about $254 million.”

The advertised budget could raise average residential tax bills by about $524. That is without fully meeting the school board’s request.

Hill commented that, “The largest net increase included in the advertised budget is to support our county schools.” This year the school board budget request includes a six percent salary increase for all FCPS employees, and other funding, totaling $253 million, or about a ten percent increase. Hill’s proposed budget included $165 million.

Burton speaking of the 10.5 percent increased school board request said, ”one might think that is really high, but as it turns out, our surrounding neighbors stepped out with a 11.3 and a 10.6 percent increase in their county transfers as well.”

Hill added, “The largest driver of the county increase portion is due to compensation, with the proposed pay and benefits increase totaling $148 million.” Compensation increases were driven by collective bargaining agreements for police, fire, and transit workers, with matching pay increases for non-represented employees.

County residents who joined the discussion, spoke either to ask questions about the increases or to advocate for spending in preferred areas. Jerry, from Hunter Mill, asked whether residents are seeing a “return on their investment” in from school funding, or are most children educated here leaving the area after high school or college graduation.

Lusk said that part of attracting companies to our area, with their jobs and revenue, is to meet their number one concern, that we have talented people to fill their vacancies; and affordable housing.

Another speaker noted real estate assessments in the last four years have risen 41 percent higher than CPI. Lusk noted the state requirement to reassess properties every year and people’s willingness to pay more for houses.

Lauren, who works with Meals on Wheels clients, said one of whom is concerned that her tax bill is higher than her mortgage once was. Lusk acknowledged that the County needs “innovative revenue sources so that home owners aren’t bearing the tax burden.” He is looking for emerging areas to offset the residential real estate taxes.

Other speakers supported public library funding and the park system. Not all questions were reached during the hour and a quarter time period.

While this would be Fairfax County’s first real estate tax rate increase in six years, residential tax bills have continued to rise due to rising assessments. While Supervisor Lusk pointed to regional market forces impacting real estate assessment, the nearby jurisdictions of Alexandria, Loudoun, and Prince William have not proposed increases to their real estate tax rates for FY25; Arlington has proposed a 1.5 cent increase.

Residents can see more about the proposed budget at: https://www.fairfaxcounty.gov/budget/sites/budget/files/Assets/Documents/fy2025/advertised/FY2025AdvertisedBudgetPresentation.pdf; or sign up to testify at the budget public hearing.