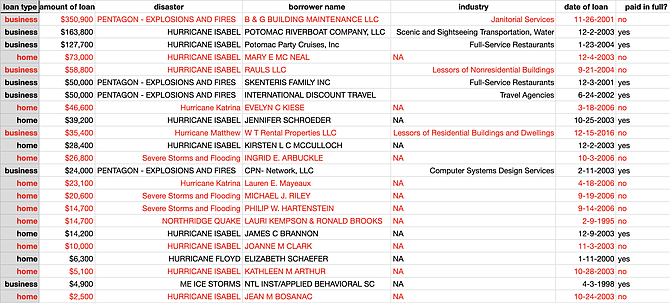

The Small Business Administration has issued more than $1 million in low-interest disaster loans in Alexandria since 1987, and most of those loans were never paid back in full, according to documents received through a public-records request.

Now, with the economy in crisis, federal officials are rolling out a new loan program that recipients won’t need to pay back in full if they keep their employees during the downturn. The move comes as businesses across Alexandria are trying to figure out how they are going to stay afloat now that Gov. Ralph Northam has ordered residents across Virginia to stay at home until June 10.

“It doesn’t surprise me that there are some of these loans that didn’t get repaid,” says Bill Reagan, executive director of the Alexandria Small Business Development Center. “The SBA does not want to harm the business.”

Most Small Business Administration disaster loans are for natural disasters like hurricanes or floods, and those are available to individuals and businesses in areas that have been declared disaster zones. Sometimes the loans are for an economic crisis like 9/11, when the federal government offers Economic Injury Disaster Loans. This year the SBA is creating a new $350 billion Paycheck Protection Program, which will be forgiven as long as the money is used to keep employees on the payroll.

"This unprecedented public-private partnership is going to assist small businesses with accessing capital quickly,” said SBA Administrator Jovita Carranza in a written statement announcing the program. "Our goal is to position lenders as the single point-of-contact for small businesses — the application, loan processing and disbursement of funds will all be administered at the community level.”

ALEXANDRIA HAS SEEN its fair share of disasters. Perhaps none, before now, were as devastating as Hurricane Isabel in September 2003, when flood waters in Alexandria rose as high as 10 feet in some places. The Small Business Administration issued more than half a million dollars in disaster loans for Hurricane Isabel, including three businesses and seven individuals. The money helped rebuild flooded structures as well as mitigate the economic crisis it created along the waterfront in Old Town.

“We had to send money back to customers because we couldn’t honor their private charter,” says Charlotte Hall, who was vice president of the Potomac Riverboat Company at the time. “We couldn’t honor their birthday party or their anniversary party, and we helped them find another venue for their wedding. And they had to pay that venue, so we had to give them their money back — understandably so.”

The Small Business Administration issued a $163,800 loan to the Potomac Riverboat Company to help keep the business afloat, literally. Hall recalls that era as a time of difficult decisions complicated by the complicated bureaucracy of navigating the federal loan application process. She says it would have been impossible without help from the Small Business Development Center, which helped her company and many others in Alexandria figure out how the federal government could help keep them in business during the recovery period.

“The challenge we had with 9/11 and Hurricane Isabel was convincing business owners to come in and apply for a disaster loan. In fact we had to request Congressman Moran to ask the president to extend the disaster loan deadlines three different times,” recalls Reagan at the Small Business Development Center. “This time it’s very different. Businesses are contacting us all day long. I get off the phone and there are 10 more calls.”

APPLYING FOR A DISASTER LOAN is no small task, and applicants are often denied. The process involves a heap of paperwork, and oftentimes borrowers have to put up so much collateral that they wonder if the loan is worth it. That was the reaction of Brett Tate after the 9/11 attack eliminated 85 percent of his Alexandria-based janitorial services company, which contracted at the Pentagon. He said navigating through the federal bureaucracy was a massive headache, although he acknowledges that the $350,900 loan helped sustain his business.

“The loans are really not helpful. What is helpful is a grant,” said Tate, owner of B&G Building Maintenance. “There’s been a lot of bailouts for banks and the car industry, and those people didn’t have to pay back one red dime.”

Tate says he paid off the 2001 disaster loan, although the SBA records show that the loan was not paid in full according to a public records request from the nonprofit Investigative Reporters and Editors. For many businesses, paying down the disaster loan can be a difficult burden — even at a low rate of interest. A 2012 report from the SBA’s inspector general showed U.S. taxpayers were owed $171 million for delinquent disaster loans. That’s part of the reason why federal officials are now rolling out the new Paycheck Protection Program, which is designed to start as a loan and then become a grant if businesses prove they were able to keep paying their employees. Businesses will be able to get as much as $2 million by showing how much money they are losing this year compared to last year.

“Businesses can look at receipts,” says Carol Chastang, a public affairs specialist with the Small Business Administration. "What they were bringing in, how they were able to pay their employees, how they were able to cover their operating expenses. And then what happens to January 1 to March 30 of this year. Clearly there will be a difference.”