The city should develop a longer-term and more comprehensive revenue strategy, especially in connection with land use and development, to meet its long-term goals, say certain finance and business professionals.

This year, as in past years, the city’s Budget & Fiscal Affairs Advisory Committee (BFAAC) recommended a Revenue Master Plan (RMP) “to grow the city’s revenue base, particularly on the commercial side.” In 2017, the Alexandria Chamber of Commerce called for a RMP “to align economic growth and capital improvement goals with strategies to increase income.” The chamber may again address revenue generation in its 2019 Legislative Agenda, said Chief Operating Officer Maria Ciarrocchi.

A RMP should entail “concrete revenue goals” and “actionable strategies,” according to BFAAC’s recommendation. It should look to a 5-10 year horizon, said former BFAAC member Laurie MacNamara.

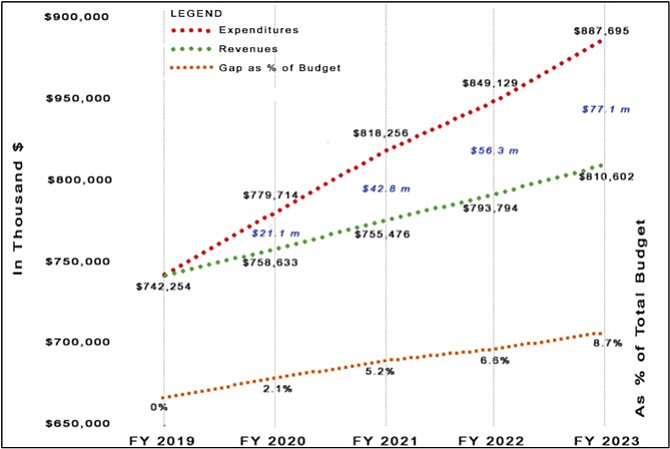

Alexandria faces a $77 million revenue gap over the next five years, said BFAAC member Skip Maginniss. It also faces gaps in relation to specific aims — for example, an oft-stated “aspiration to get us to a 50/50 balance between real estate taxes and the constellation of business taxes, so we are not putting such a burden on our residential taxpayers,” said MacNamara. But the city hasn’t laid out what “we need to do as a city to achieve the revenue that’s going to be required.”

“It’s a three-legged stool,” she said. First, “raising more money from current sources.” Second, “diversifying the revenue base with new sources, probably bringing businesses into the city. But there may be other ways to do that, like federal grants, more money from the state, public-private partnerships, other ways.” Third, “cutting costs. … What’s the combination of those three things that we’re to do …?”

Business-attracting development is a main new revenue opportunity.

“We just do not have 21st century, Class-A office space in any significant way,” said MacNamara. Though the Patent and Trademark Office and the National Science Foundation are big clients, her employer doesn’t have major offices in Alexandria. Instead, she commutes to Tysons Corner. She says Arlington is also worth emulating. She encourages the “larger scale development” slated in Potomac Yard and Eisenhower. But overall “we’ve got our lunch being eaten by the rest of Northern Virginia.”

“Growing the tax base whether through retail, office or hotels is vitally important to the city’s health. These types of land uses generate far more in tax revenue than they consume,” said City Manager Mark Jinks. The city already makes “capital investments in areas … which will induce development” and markets to businesses through the Alexandria Economic Development Partnership (AEDP). He says Alexandria does have Class-A office space, and would probably have more, but for a sluggish and glutted market.

“I would not agree that there is no strategy. One can look at land use plans that the city has adopted to identify a clear redevelopment and therefore revenue growth strategy,” he said. “We can accelerate market demand to a certain degree by marketing and with targeted incentives, but in a slow growing region with many competing commercial corridors and redevelopment areas, there is only so much that the needle can be pushed.”

Others suggest a RMP might include quantifying the price tags attached to land use decisions. This could help the city better understand the economic and budget consequences of its posture toward development — and, conversely, the posture necessary to generate sufficient revenues to achieve the level of services that residents want.

Former OMB Director Nelsie Birch suggests developing “some revenue models — maybe aggressive development, middle development, and low development — [showing] what the revenue picture’s going to look like” as a result. If we want to stay “a bedroom community” without commercial development like Arlington, here’s “what our budget looks like if we start to pull back on development.” If we want to pursue “much more density, much more development” in the West End, here are “some revenue models around that.” Though Jinks says the city’s 5-year Financial Planning Model already does this “to some extent.”

“There’s nothing that is holding the city accountable to making some of these larger … [development] decisions, one way or the other, because there is no revenue vision/strategy/plan/roadmap,” said MacNamara. “So you can make a lot of little decisions which are not optimized for filling your revenue gap. … And not even realizing that you’re making those decisions.”

At an April 18 work session, Vice Mayor Justin Wilson suggested that large planning efforts might include finer-grained financial modeling. This would provide “a layer of rigor on top of your land use decisions that now informs your long-term financial plan. I think that requires a level of analysis that I don’t know we fully do.”

When council previously pursued something similar, “there was a lot of pushback because of the work that’s involved,” said Councilman Paul Smedberg.

Another possibility entails “moving to … multi-year budgeting,” said Wilson. Though Jinks thinks that could make the city “less responsiveness to changing needs.”

The city could also tweak its staffing.

“If you had targets for revenue, and someone with responsibility for accomplishing those targets, they would have some urgency about leveraging tools outside those traditional ones. … We recommend that an individual be responsible for capturing money from federal, state, not-for-profits,” said BFAAC member Robert Shea. “The federal government’s going to spend more money in the next six months than probably ever in its history. So have we pivoted in some way, because someone’s got responsibility for chasing those sources?”

Jinks says other possibilities include “obtaining increased taxing authority from the state (such as getting the authority to apply the sales tax or a user tax to ride sharing companies such as Lyft and Uber);” “public-private partnerships … to deliver public investments or services;” and “adopting revenue policies which change tax supported services (building permits, recreation services, solid waste collection, storm water) to a fee supported basis.”

Find more information at www.alexandriava.gov/BFAAC.